If you’re interested in DSCR loans, it’s important to understand the current interest rates and how they may affect your borrowing decisions. In this article, we’ll cover everything you need to know about DSCR loan interest rates in May 2023.

What are DSCR Loan Interest Rates for May 2023?

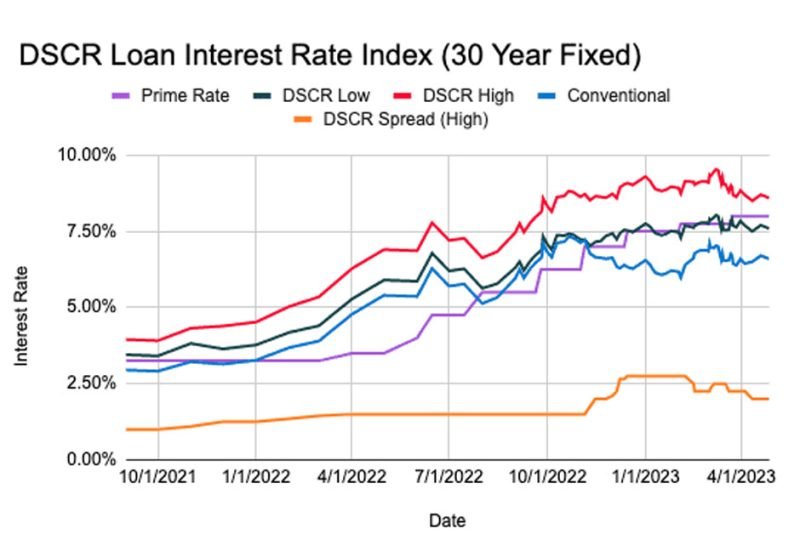

As of April 27, 2023, the average DSCR rates range from 7.59% to 8.59%. These rates are based on a 30-year fixed loan with a 25% DSCR down payment, a 1.2 DSCR ratio, and a 3-2-1 prepayment penalty. These rates are higher than the average conventional loan rate of 6.59% according to Freddie Mac. Keep in mind that the typical DSCR loan charges 2 points plus standard closing costs for these rates.

How Do DSCR Rates Compare to Conventional Loan Rates?

DSCR loan interest rates are 1.00% to 2.00% higher than Fannie Mae and Freddie Mac conventional rates as of April 27, 2023, according to OfferMarket’s DSCR Loan Index.

How Can You Get a Lower DSCR Rate?

When considering DSCR lenders, it’s important to shop around and compare rates and fee structures. By doing so, you may find a lender who offers you a better rate and fee structure than another.

To improve your debt service coverage ratio and qualify for a lower DSCR rate, consider making a larger down payment or bringing a more solid deal to the table. Additionally, gaining more experience as a landlord and investor may also help you qualify for a lower rate.

Can You Lock in a DSCR Rate?

Yes, you can lock in a DSCR rate. Be sure to ask your lender about the process and any associated fees.

What Factors Affect DSCR Rates?

Besides the macro economy, several factors may affect your DSCR rate, including the property’s cash flow, your real estate investing experience, credit score, loan-to-value ratio, loan amount, and prepayment penalty period.

Are There DSCR ARM Rates Available?

Yes, adjustable-rate mortgages (ARMs) may offer lower DSCR rates. However, it’s important to carefully consider the risks associated with ARMs, such as the potential for rates to skyrocket and negatively impact your rental property cash flow.

Conclusion

If you’re considering a DSCR loan, be sure to understand the current interest rates and how they may affect your borrowing decisions. Shop around for lenders and consider ways to improve your debt service coverage ratio to qualify for a lower rate. By doing so, you can make an informed decision and secure the best possible terms for your investment.