Insurance plays a pivotal role in safeguarding individuals, businesses, and assets against unforeseen risks and losses. From health emergencies to property damages, insurance offers a financial safety net, providing peace of mind in times of distress. However, navigating through the myriad of insurance options can be daunting, with each type serving a unique purpose and coming with its own set of costs. In this comprehensive guide, we’ll delve into the various types of insurance available, shedding light on their coverage, benefits, and associated expenses. By understanding these nuances, individuals and businesses can make informed decisions to protect their interests effectively.

Health Insurance

Health insurance stands as a cornerstone of personal financial planning, offering coverage for medical expenses incurred due to illness or injury. It encompasses a wide range of services, including hospitalization, doctor visits, prescription medications, and preventive care. The cost of health insurance varies significantly based on factors such as age, location, coverage level, and pre-existing conditions. Premiums may be higher for comprehensive plans with lower deductibles and broader networks, while catastrophic plans come with lower premiums but higher out-of-pocket costs. Additionally, employer-sponsored health insurance often subsidizes a portion of the premium, reducing the financial burden on employees. However, with the rising cost of healthcare and the evolving regulatory landscape, individuals must carefully evaluate their health insurance options to ensure adequate coverage without breaking the bank.

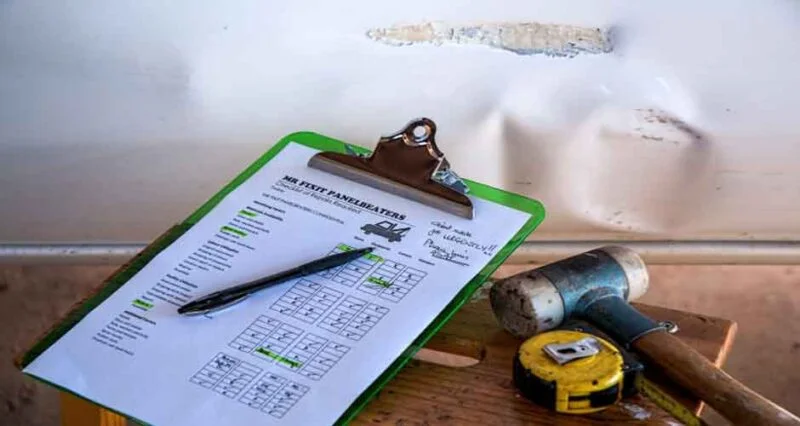

Auto Insurance

Auto insurance is a legal requirement in most jurisdictions, providing financial protection in the event of vehicle accidents, theft, or damage. It typically comprises several components, including liability coverage, which pays for damages to others’ property or injuries they sustain in an accident where the insured party is at fault, and collision and comprehensive coverage, which covers damages to the insured vehicle. The cost of auto insurance depends on factors such as driving history, vehicle type, age, and geographic location. Drivers with a clean record and low-risk vehicles may qualify for lower premiums, while those with a history of accidents or driving violations may face higher rates. Moreover, the cost of auto insurance can vary significantly between insurance companies, underscoring the importance of shopping around for the best rates.

Homeowners Insurance

Homeowners insurance offers financial protection for one’s home and personal belongings against perils such as fire, theft, vandalism, and natural disasters. It encompasses several types of coverage, including dwelling coverage, which pays for repairs or rebuilding of the home’s structure, and personal property coverage, which reimburses for damaged or stolen belongings. Additionally, homeowners insurance typically includes liability coverage, which protects against lawsuits arising from injuries or property damage sustained by others on the insured property. The cost of homeowners insurance depends on factors such as the home’s location, age, construction type, and coverage limits. Homes in high-risk areas prone to natural disasters or crime may incur higher premiums while installing security systems or making home improvements can potentially lower insurance costs.

Life Insurance

Life insurance serves as a financial safety net for loved ones in the event of the policyholder’s death, providing a tax-free lump sum payment to beneficiaries. It comes in various forms, including term life insurance, which offers coverage for a specified period, and permanent life insurance, which provides lifelong coverage with an investment component. The cost of life insurance depends on factors such as age, health status, coverage amount, and type of policy. Generally, younger and healthier individuals enjoy lower premiums, while those with pre-existing conditions or higher coverage needs may pay more. Additionally, lifestyle choices such as smoking or engaging in high-risk activities can impact insurance rates. Evaluating one’s financial obligations and long-term needs is crucial in selecting the right life insurance policy at an affordable cost.

Business Insurance

Business insurance encompasses a wide range of coverage options designed to protect companies against various risks and liabilities. It includes property insurance, which covers physical assets such as buildings, equipment, and inventory against damages or losses due to fire, theft, or other perils. Liability insurance is another critical component, shielding businesses from legal claims and expenses arising from injuries, property damage, or negligence. Additionally, business interruption insurance provides financial assistance to cover lost income and expenses in the event of a temporary shutdown due to covered perils. The cost of business insurance varies depending on factors such as industry type, revenue, location, and coverage needs. Small businesses may opt for package policies tailored to their specific requirements, while larger enterprises may require customized coverage options. Assessing potential risks and liabilities is essential in securing adequate coverage without overpaying for insurance premiums.

Workers Insurance

Workers’ compensation insurance is a crucial safeguard for businesses, providing coverage for employees’ medical expenses and lost wages in the event of work-related injuries or illnesses. It not only protects workers but also shields employers from potential lawsuits arising from workplace accidents. The workers comp insurance cost varies depending on factors such as industry type, payroll expenses, and claims history. Industries with higher risk factors, such as construction or manufacturing, may face higher premiums due to the increased likelihood of workplace injuries. Employers can mitigate workers’ compensation insurance costs by implementing safety protocols, promoting a culture of workplace safety, and promptly addressing any hazardous conditions.

Travel Insurance

Travel insurance offers protection against unforeseen events that can disrupt travel plans, including trip cancellations, medical emergencies, lost luggage, and travel delays. It provides reimbursement for non-refundable expenses and covers medical expenses incurred while traveling, ensuring peace of mind during domestic or international trips. The cost of travel insurance depends on factors such as trip duration, destination, age of travelers, and coverage options. Basic plans typically offer essential coverage at lower premiums, while comprehensive plans provide broader protection with higher premiums. Travelers should assess their travel itinerary and potential risks to select the most suitable travel insurance policy for their needs, balancing coverage with affordability.

In conclusion, insurance serves as a vital tool in mitigating risks and protecting against unforeseen losses across various facets of life and business. From health emergencies to property damages and liability claims, insurance offers financial security and peace of mind in times of need. However, understanding the different types of insurance available and their associated costs is crucial in making informed decisions and maximizing coverage while managing expenses. Whether it’s health, auto, homeowners, life, or business insurance, individuals and organizations must assess their unique needs and risk profiles to select the most suitable policies at competitive rates. By prioritizing protection without overburdening finances, insurance ensures resilience and stability in an ever-changing world.